2025 Year End Review

📰 Monday, January 12, 2026:

Welcome to the FVEr Invest Blog: Your Guide to Data-Driven Market Analysis

Hello FVEr Invest Subscribers!

Thank you to our new and continuing subscribers for your support of our platform. Our goal is to bring you frequent market insights, using our proprietary FVE algorithm to help you gain a clearer understanding of market dynamics.

Disclaimer: The FVEr Invest blog and website should not be construed as specific investment advice, and our approach is not suitable for everyone. It is intended to demonstrate what our algorithmic strategy is doing each week, with insight into how we are thinking about the stock markets, and how we approach investing through a data driven lens. Investing involves risk, and our models are inherently uncertain. Please consult a professional and licensed investment advisor for investment advice.

Year End Review

The FVEr Trading Strategy started live trading in mid-April 2025, following the finalization of our technical infrastructure. While this launch coincided with the aftermath of the high-volatility "Tariff Sell-off," the timing was purely a result of our internal setup timeline rather than a deliberate attempt to avoid market turbulence. Moving into 2026, we are interested to see the strategy function through a major, sustained sell-off similar to last year’s meltdown. Such a period will serve as a stress test for our model’s resilience.

By design, the strategy is measured on a Monday-to-Monday cycle across six broad market ETFs (SPY, IJH, IJR, IWM, DIA, and QQQ), and nine of the eleven S&P sectors (XLV, XLP, XLU, XLI, XLE, XLB, XLK, XLF, and XLY). We continue to exclude Real Estate (XLRE) and Communication Services (XLC) because these relatively newer sectors lack the deep-history datasets required for the high-conviction signals our framework demands.

Our performance through January 5, 2026 demonstrates a strategy that increases risk at statistically opportune times. Across 348 total weeks of cumulative observation, the model triggered a leveraged or inverse position 29% of the time (101 weeks), remaining neutral for the other 71% of the weeks.

When the model did engage in leverage or inverse exposure, it exhibited a 63% win rate. These winning weeks captured an average gain of 5.97%, beating the 37% of weeks that resulted in a loss, where the average downside was 3.38%. By winning more often than it loses, and with the magnitude of those wins more than the losses, the FVEr strategy has thus far outperformed. While we recognize that the post-April 2025 environment was relatively productive, we hope to continue the structural asymmetry of these returns, which will provide a strong foundation for long-term growth.

Broad Market Analysis

The FVEr Trading Strategy’s performance across our six broad market ETFs underscores the model's ability to capitalize on short term undervalued opportunities via the 7 week SMA trigger, and long term undervalued opportunities via the FVE algorithm trigger. The 7 week SMA usually triggers short term leverage exposure during near term pullbacks in a general upward market, and the FVE algorithm usually triggers longer duration leverage exposure when a particular ETF is significantly undervalued.

Performance Breakdown

The following chart reflects cumulative performance from each asset's respective strategy inception date through January 5, 2026:

Key Performance Drivers:

Small and Mid-Caps Shine: The best results emerged from IJR and IJH. While the benchmark IJR returned 27.86%, the 2x FVEr strategy nearly doubled that output at 53.97%. Similarly, the 3x implementation for IJH delivered a 54.30% return, more than doubling the benchmark’s 23.20% performance. Most of this outperformance came early in the year during the climb out of the tariff low, via the long term FVE signal. That said, the SMA signal was broadly triggered a few times: early August, early October, and late November.

Consistency Across Large Caps: In the large-cap ETFs, SPY and DIA, the model also outperformed the benchmarks, but by smaller margins because most large caps ETFs only briefly dipped below the FVE trigger during the tariff sell off, and the outperformance came from the few short term sell offs through the summer and fall.

More Caution in Tech (QQQ): While the QQQ delivered a 16.42% benchmark return, the FVEr 3x returned only 22.45%, because our model viewed the technology sector as fundamentally overvalued, leading to a more defensive stance.

Sector Performance Analysis

The application of the FVEr Trading Strategy across nine S&P sectors further demonstrates the model’s ability to generate alpha, even within narrow vertical slices of the market that have more volatility and are more prone to volatility drag. By applying our systematic framework to these sectors, we have seen the model successfully navigate varying economic cycles, from defensive rotations into Utilities to the moderate overvaluation concerns within Technology.

Performance Breakdown

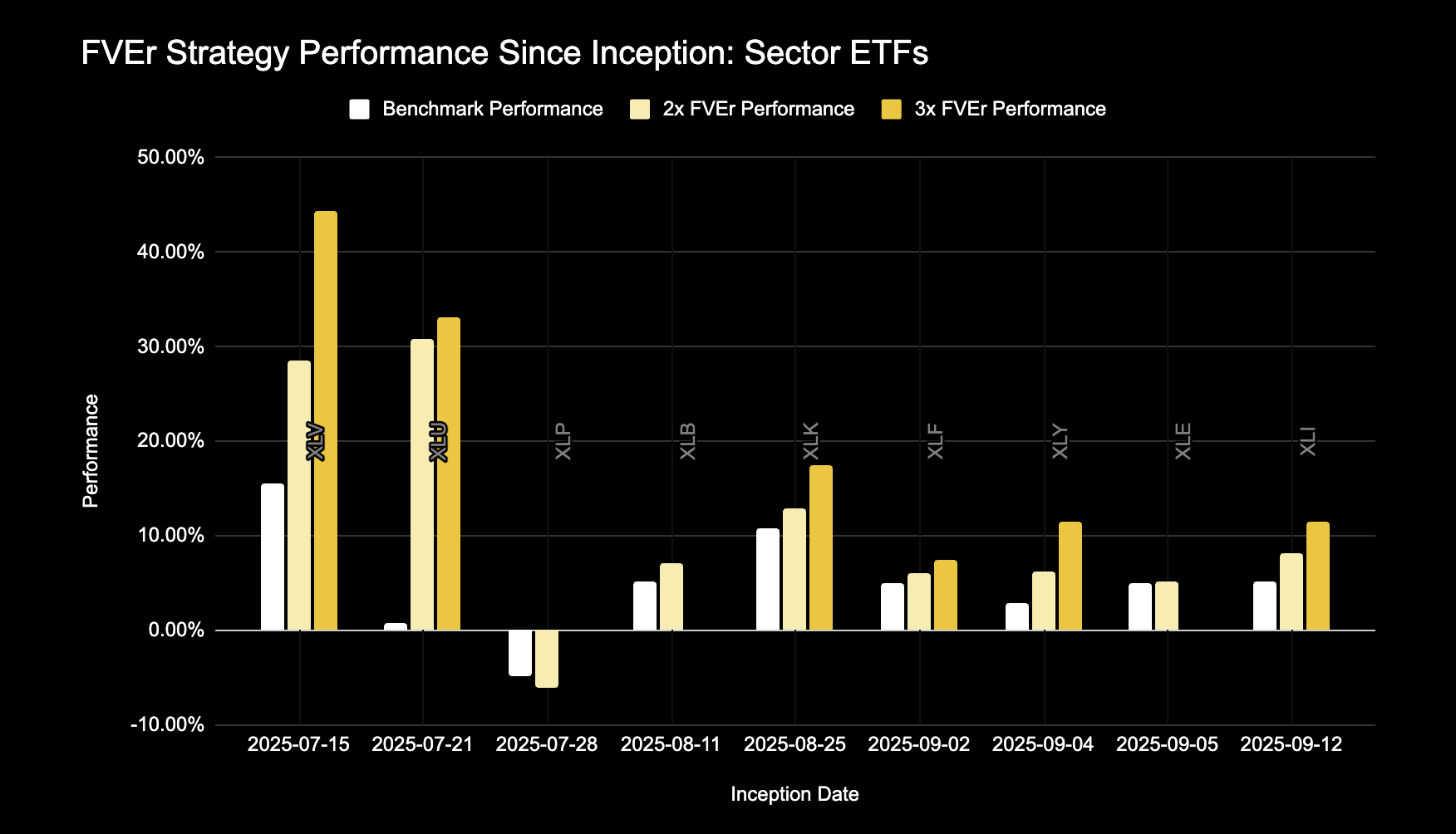

The following chart details the performance of our nine tracked sectors from their respective inception dates through January 5, 2026:

Key Performance Drivers:

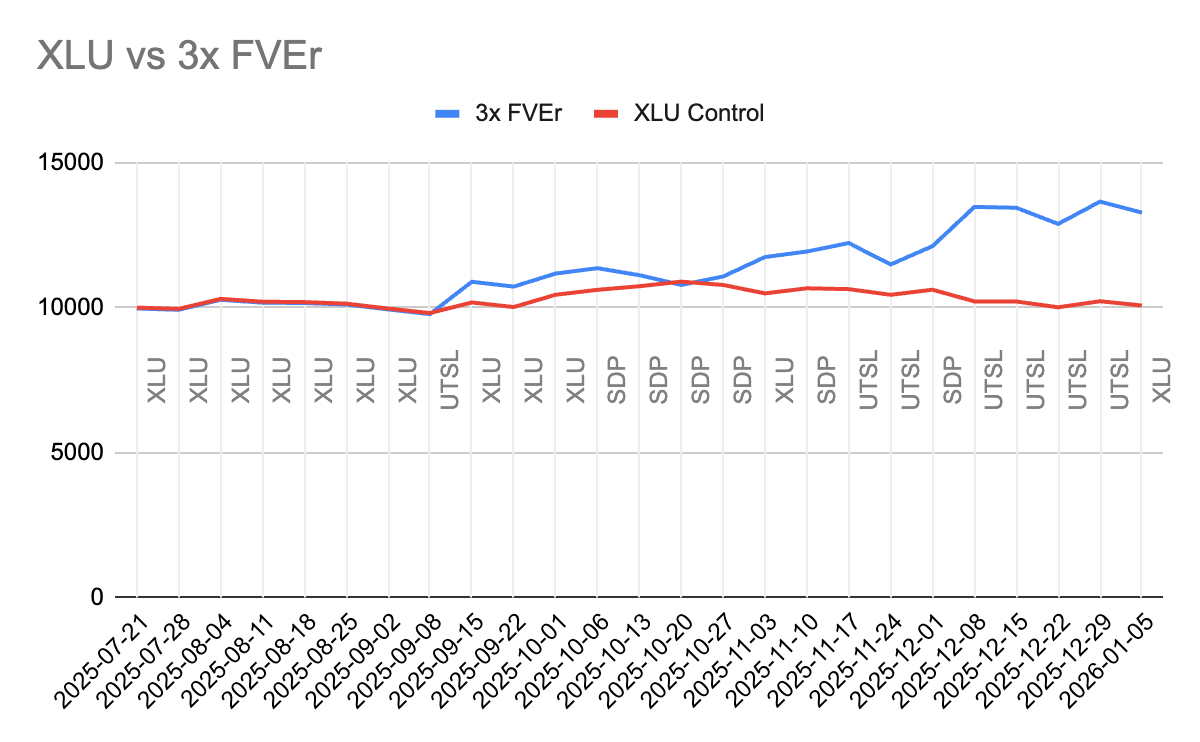

The Utilities Anomaly (XLU): Perhaps the most striking observation of the FVEr model thus far is found in XLU. While the benchmark remained virtually flat at 0.72%, our 3x strategy delivered a 33.16% return. This highlights the model's capacity to extract significant gains from "boring" sectors by timing leveraged exposure. The below graphic demonstrates the week to week allocation of our 3x XLU strategy with UTSL being the 3x leveraged XLU ETF, and SDP being the -2x inverse XLU ETF. The see-sawing that occured between UTSL (3x) and SDP (-2x) in November and December is an extremely rare event from our research, and it underscores the volatility around this sector likely due to how investors are viewing XLU in the context of AI.

Healthcare Outperformance (XLV): Healthcare provided the strongest absolute returns among the sectors. The 3x FVEr strategy nearly tripled the benchmark's 15.46% return, ending at 44.30%.

Tech Sector Discipline (XLK): Consistent with our view on the QQQ, the XLK (Technology) sector was approached with caution. While the benchmark rose 10.85%, our 3x performance was a measured 17.41%. Our model’s assessment of overvaluation in the tech space led to a more conservative posture, to avoid being exposed to leverage during a severe tech sell off.

The Challenge of Staples (XLP): XLP remains the only sector where the strategy trailed a negative benchmark, returning - 6.04% against the benchmark - 4.90%. In a sustained downward trend for Consumer Staples, the leveraged exposure during active weeks amplified the benchmark's decline, which normally occurs during the early stages of leverage exposure while the trough is developing. There are signs of recovery this week in XLP, up about 2%, which is helping the strategy although it is not reflected in this report.

Summary

To conclude, we want to remind our readers that our trading strategy uses leveraged ETFs which are risky investment vehicles. In earlier blogs, we highlighted in detail some of the risks that you need to consider when using these kinds of ETFs, including volatility drag, and severe capital losses during extreme sell offs. As an example, our backtested 3x SPY strategy had a 30% draw down in one week during the tariff meltdown. Moreover, the volatility criteria worked against us in that situation, and kept the strategy out of leverage on the big bounce back rally the next week. As a result the SPY backtest is still recovering. However, the volatility criteria was not triggered in IJH or IJR, and those strategies quickly recovered their losses during the rebound. What does this mean for an investor using the strategy?

We do the strategy in all six broad market ETFs, and all sectors as well, with more weight going to the broad market ETFs, and less weight going to the sectors. Diversification is your friend, and we would not do the strategy in only SPY, for example.

We only put a small percentage of our net worth / savings in our strategy, and periodically sweep profits from the wins into a boring un-leveraged index fund, to cap percent exposure to leveraged ETFs.

In summary, throughout the first half of 2025, the model correctly identified an opportunity in Small and Mid cap areas of the market, and throughout the second half of the year, our model was on point regarding how to approach the Healthcare and Utilities sectors.

We started live trading after back testing and refining the strategy over the course of two years. Some people may think this means that our strategy has been “over fit” to the data, and will not be resilient in diverse market environments. We hope that is not the case, and don’t think that is the case, because our trading strategy does not change from one sector to another, or from one time frame to another. We have specifically worked to develop as universal parameters and thresholds as possible so as not to overfit the data.

As we kick off 2026, we have a small favor to ask: if you have found value in this website or our blog, please share it with a colleague or friend. Thank you for your continued trust, and here’s to a prosperous and statistically favorable new year.

📈 FVEr Weekly Market Update: January 12, 2026

The Utilities whipsaw continues. The model has moved XLU back into leverage this coming week.

XLP (Consumer Staples) remains in leverage but had a notable rally last week, largely due to an 8% rise in Costco (COST), which holds a 10% weight in XLP.

Every other position is in un-leveraged status.

See you next time. In the meantime, please don't hesitate to reach out if you have any questions.

The FVEr Team

Unlock Deeper Insights: Schedule a Learning Session

As a valued member, we encourage you to take advantage of a personalized 30-minute learning session with one of our co-founders. This is your opportunity to get tailored guidance on how to interpret our data and effectively implement our strategies in your own investment approach.

To schedule your session, simply email us at info@fverinvest.com with the subject line: "Learning Session". (Please note: We do not provide specific investment advice.)